zerohedge.com

Clustered Story

Futures , Global Markets Rise With US Markets Closed For President Day

zerohedge.com · Feb 16, 2026 · Collected from GDELT

Summary

Published: 20260216T170000Z

Full Article

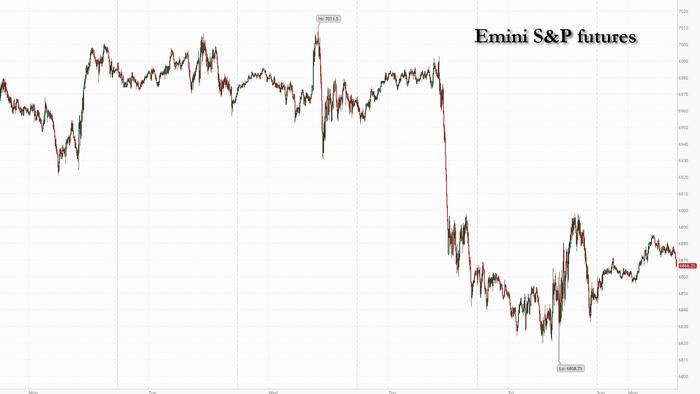

Stocks gained, bitcoin tumbled and bonds steadied after Friday's cool CPI data reinforced expectations that the Fed will cut interest rates on multiple occasions this year. With US markets closed for the Presidents’ Day holiday and mainland China’s markets closed for Lunar New Year holidays, trading was muted on Monday. As of 9:00am ET, futures on the S&P 500 added 0.4% and Europe’s Stoxx 600 index rose 0.4% as banking shares rebounded from a sharp decline last week. German bunds and Treasury futures were steady after US yields touched the lowest since December on Friday.The path of US interest rates remains in focus following Friday’s slower-than-expected US inflation print as traders fully price a Fed cut in July and the strong chance of a move in June. “The backdrop for equities is positive post CPI,” said Andrea Gabellone, head of global equities at KBC Securities. At the same time, there could be “more dispersion ahead as sentiment around key AI-exposed sectors is still very critical,” he added. That sentiment was echoed by other strategists seeking to distinguish between AI losers and winners.A JPMorgan Chase & Co. team led by Mislav Matejka urged caution on stocks at risk of AI-driven “cannibalization,” including software, business services and media companies. Meanwhile, banks are developing baskets to capitalize on the divergence: as we first reported last Thursday, Goldman launched a new basket of software stocks that goes long firms that will benefit from AI adoption, while shorting the companies whose workflows could be replaced. With AI disruption rippling through markets, a lot will come down to earnings resilience, in particular in the US. “When you look at the current earnings season, the companies are showing 13% of growth,” Nataliia Lipikhina, head of EMEA equity strategy at JPMorgan, told Bloomberg TV. “Overall, this is the reason why we continue to be positive on the S&P.”Later this week, traders will be watching for ADP private payrolls numbers on Tuesday and the minutes from the Fed’s January meeting on Wednesday for a fresh read on the economy.European stocks gained with bank shares rebounding, after posting their biggest weekly decline since April on worries about disruption from artificial intelligence. The basic resources sector lags, with Norsk Hydro among Europe’s worst performers as both Goldman Sachs and RBC downgrade the stock. Stoxx 600 rises 0.4% to 620.26 with 253 members down, 336 up, and 11 unchanged. Here are some of the biggest movers on Monday: NatWest shares rise as much as 4%, the most since October, as Citi analyst Andrew Coombs raises his price target on the UK bank to a Street-high.Seraphim Space shares rise as much as 9.2%, briefly hitting a new all-time high, after the space tech investment firm said the valuations of its four largest holdings increased over the final months of 2025.AECI shares rally as much as 6.1%, the most since July, after the South African commercial-explosives maker shared improved 2025 headline earnings per share guidance.Orsted shares rise as much as 3.8% after analysts at Kepler raise the recommendation to buy from hold over the Danish renewable energy firm’s outlook, despite ongoing uncertainty for the industry in the US.Norsk Hydro shares fall as much as 4.4%, extending Friday’s 5.9% earnings-triggered drop, after being downgraded at Goldman Sachs and RBC over disappointments and pricing pressures in the Norwegian aluminum company’s downstream business.Galderma shares slip as much as 2.2% after naming Luigi La Corte as its new chief financial officer following the news back in July that Thomas Dittrich was departing.Pinewood Technologies shares tumble as much as 32%, the most since April 2024, after Apax Partners said on Friday it will not proceed with a possible cash offer for the car dealership software provider.FlatexDEGIRO shares drop as much as 7.2% after BNP Paribas downgraded the online brokerage firm to neutral from outperform, saying the price reflects too much optimism about its market position in Germany.Maurel & Prom shares slump as much as 12%, pulling back after ending last week at a 2015-high, after announcing it is not currently authorized to resume oil and gas operations in Venezuela.Barratt Redrow shares fall as much as 3.7%, leading a drop in British homebuilders after Rightmove said house prices are stalling.Asian stocks slipped for a second day, led by declines in Japan as traders booked profits after last week’s post-election rally. Several markets were closed or held shortened trading sessions for the Lunar New Year holiday. The MSCI Asia Pacific Index was down 0.1%. Japan’s Topix Index fell 0.8%, with Mizuho Financial Group Inc. and Toyota Motor Corp. among the companies contributing to the index’s losses.In Hong Kong, AI model developer Minimax Group Inc. surged as much as 30% to more than four times its original listing price, while competitor Knowledge Atlas JSC Ltd. ended 4.7% higher. The market will be closed until Thursday. As investors across the region begin to reevaluate their bets on its artificial-intelligence-driven rally, traders in Japan cashed in gains driven by expectations of Prime Minister Sanae Takaichi’s proactive spending policies last week.Trading in Singapore ended early Monday and will be shut until Wednesday. Equity markets in mainland China, South Korea, Indonesia and Vietnam were closed. In FX, the yen is the notable mover in currencies, weakening 0.5% against the dollar and pushing USD/JPY back above 153. The offshore yuan is one of the better performers against the greenback. The Bloomberg Dollar Spot Index rises 0.1%.There is no cash trading in Treasuries due to the Presidents’ Day holiday. European government bonds are little changedIn commdities, gold dipped below $5,000 an ounce, as traders booked profits from a gain in the previous session. Bitcoin tried anf ailed to stage a modest rebound; it last traded around $68,275 after posting its fourth consecutive weekly loss, with the cryptocurrency struggling to find clear direction as a weekend rally fizzled once the momentum ignition algos emerged. WTI crude futures tread water near $62.90 a barrel. Top HeadlinesPresident Trump said there will be voter ID rules in the mid-term elections this year, whether Congress approves it or not, and they will present a legal argument in an Executive Order. Furthermore, Trump said he has searched the depths of legal arguments not yet articulated nor vetted on this subject, and they will be presenting an irrefutable one in the very near future.Iran says potential energy, mining and aircraft deals on table in talks with US: RTRSPentagon threatened to cut its ties with Anthropic over the company’s insistence that some limitations are kept on how the military uses its AI models: RTRSUK eyes rapid ban on social media for under 16s, curbs to AI chatbots: RTRSRampant AI Demand for Memory Is Fueling a Growing Chip Crisis: BBGWarner Bros. Weighs Reopening Sale Negotiations With Paramount: BBGCompanies Are Replacing CEOs in Record Numbers—and They’re Getting Younger: WSJEurope aims to rely less on US defence after Trump's Greenland push: RTRSDOJ Tells Lawmakers Epstein File Redactions Complied With LawL BBGFor College Applicants, Pressure to Make Summers Count Has Gotten Even Worse: WSJFed's Goolsbee (2027 voter) said on Friday that they are still seeing pretty high services inflation, and he hopes they have seen the peak impact of tariffs, while he added that the job market has been steady, with only modest cooling. The Break Is Over. Companies Are Jacking Up Prices Again: WSJTrade/TariffsUSTR Greer said the US and Ecuador expect to sign a trade agreement in the coming weeks.China will waive import value-added taxes on selected seeds, genetic resources, and police dogs through to 2030 to increase agricultural competitiveness and breeding capacity. It was also reported that China will grant zero-tariff access to 53 African nations from May 1st, according to Bloomberg.Chinese Foreign Minister Wang Yi told his French and German counterparts that China and the EU are partners, not rivals, while he added that China and the EU should manage differences, deepen practical cooperation and work together on global challenges.A more detailed look at global markets courtesy of NewsquawkAPAC stocks began the week in the green but with gains limited following a lack of major fresh catalysts from over the weekend and amid thinned conditions owing to holiday closures in the region and North America. ASX 200 traded marginally higher with upside led by tech, although gains are capped by underperformance in the utilities, mining, materials and resources sectors, while participants also digested a slew of earnings releases. Nikkei 225 traded indecisively with the index constrained by disappointing Japanese preliminary Q4 GDP data, which showed the economy returned to growth but failed to meet expectations with GDP Q/Q at 0.1% (exp. 0.4%), and annualised GDP at 0.2% (exp. 1.6%). Hang Seng finished higher in a shortened trading session on Chinese New Year's Eve but with upside limited by tech weakness amid some confusion after the Pentagon added several companies including Baidu, Cosco, BYD, Huawei, Nio, SMIC, Tencent, and more to a list of Chinese firms aiding the military on Friday, but then withdrew the updated list shortly after it was posted. Furthermore, price action was also restricted by the closure of mainland markets and the absence of stock connect flows, which will remain shut for more than a week. US equity futures kept afloat in quiet trade amid the absence of drivers and participants. European equity futures indicate a mildly positive cash market open with Euro Stoxx 50 futures up 0.1% after the cash market closed with losses of 0.4% on Friday.Asian HeadlinesChinese President Xi called for the anchoring of economic growth around domestic demand as its main driver, in a speech during a key policy meeting late last

Share this story