hydrogenfuelnews.com

Green Hydrogen E - Fuels Facility Set For $5 . 3B Investment In Uruguay – Hydrogen Fuel News

hydrogenfuelnews.com · Feb 20, 2026 · Collected from GDELT

Summary

Published: 20260220T124500Z

Full Article

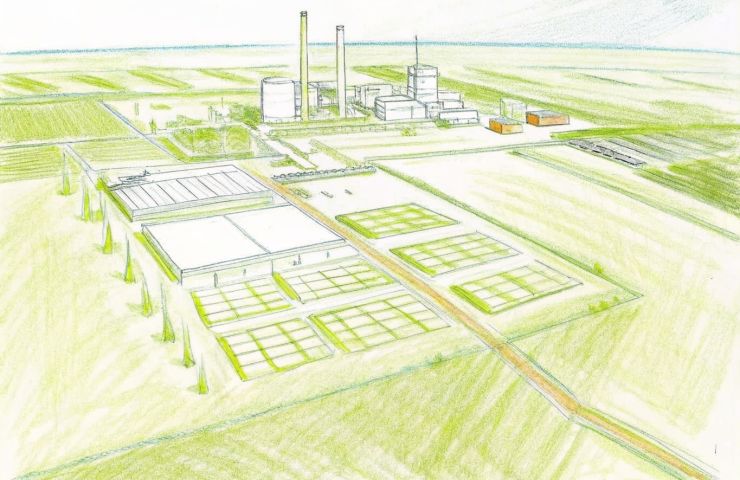

Late November 2025, Uruguay’s Ministry of Environment gave the green light—literally, the Environmental Location Feasibility Approval (AAP)—to HIF Global for their new green hydrogen and e-fuels complex in Paysandú. At a whopping $5.3 billion (€4.25 billion), it’s now the largest foreign direct investment Uruguay’s ever seen, topping the old UPM pulp mill record. Suddenly, instead of all the action sticking to Montevideo’s coast, the spotlight is shifting inland.Analysts are calling it the Green Hydrogen Super-Cycle—where breakthroughs in green hydrogen production and policy support collide. Europe’s drive to decarbonize is fueling demand for zero-emission fuels, and Uruguay’s steady governance combined with clear regs has put it on the map as a go-to partner for sustainable energy. On top of that, both the Uruguayan and German governments have put their stamp of approval—and their balance sheets—behind this project. This isn’t just about shiny factories—it’s about jumpstarting affordable hydrogen production and reshaping economic geography.Project OverviewSo, what’s the plan? The Paysandú facility is designed to crank out up to 880,000 tonnes of carbon-neutral e-gasoline every year—that’s roughly 256 million liters made by blending renewable green hydrogen with captured CO₂. At that scale, it ranks among the largest e-fuels hubs globally.And they’ve locked down the money side:Offtake deals with Porsche and Germany’s eFuel One, guaranteeing hard-currency sales.Equity raise of $220 million in 2024 to fuel HIF Global’s growing e-fuels portfolio.Government MOU signed in December 2025, setting up High-Level and Technical Committees to sort out permits, infrastructure, and timelines.Thanks to those contracts, revenue’s insulated from peso swings, which makes banks and investors a lot happier.Technology and CapacityUnder the hood, the plant features a 1.8 GW electrolysis array—powered by the Lucía Solar Park and Elena Wind Park—that splits water into hydrogen and oxygen. There’s also a Direct Air Capture (DAC) pilot unit pulling 600 tonnes of CO₂ out of the air each year, plus a deal with state-owned ALUR to channel biogenic CO₂ from ethanol fermentation back into the synthesis loop.Together, these innovations let the site produce enough carbon-neutral e-gasoline to decarbonize over 150,000 vehicles annually. And since everything’s built on modular units, bumping up electrolyzer or DAC capacity later on is practically plug-and-play—strengthening the local hydrogen infrastructure as demand grows.HIF Global isn’t flying blind—they’ve learned a ton from their pilots in Chile and Uruguay, using real-world data to de-risk this gigawatt-scale rollout.Environmental and ESG ConsiderationsEnvironmentally, the design is robust:Land use efficiency: vertical integration keeps the industrial footprint tight.Ecological offsets: boosting the bioreserve area by 70% to protect local flora and fauna.Water management: rainwater harvesting systems meet much of the process water needs, easing stress on aquifers.When Argentina’s City of Colón raised cross-border impact concerns, Uruguay’s team hashed out mitigation measures through diplomatic talks—showing they can navigate big, multinational projects with finesse.Local Transformation: The Paysandú PivotLocals are already dubbing this the “Paysandú Pivot.” For a city more known for rivers than refineries, this is upheaval—and in a good way. We’re seeing an exec housing boom and a flurry of new schools, clinics, and shops gearing up to serve engineers and construction crews pouring in.City planners expect a wave of secondary businesses—maintenance services, equipment suppliers, even hospitality spots—anchored to the plant’s ecosystem. And once logistics corridors open, Paysandú could attract e-fuels blending terminals or even clean energy research hubs. It’s a grassroots story of industrial decarbonization sparking rural renewal.Financing and Risk MitigationFinancially, the picture’s just as solid. After securing $220 million in equity, HIF Global’s in talks with multilateral development banks and export-credit agencies to round out project finance. Pricing contracts in euros and dollars shields them from peso volatility, while partnering with ALUR brings sovereign backing—dialing down political risk.For lenders, the combo of green approvals, firm offtake agreements, and government guarantees offers a sweet risk-return profile. This structured financing model could well become the template for future high-stakes sustainable energy projects.Economic and Geopolitical ImpactThis is a genuine game-changer for Uruguay’s economy: about 1,400 jobs during construction and some 300 permanent operations roles once the plant’s up and running. That’s a significant bump for local employment.On the strategic side, Europe scores a fresh source of low-carbon fuel, boosting its energy security. Uruguay safeguards earnings by tying revenues to euros and dollars and meshes smoothly with the Mercosur–EU trade agreement, giving renewable exports a strong legal backbone.Germany’s engagement goes beyond buying e-fuels—they’re offering policy support and even concessional financing through their development agencies. Uruguay is flirting with the nickname “Rotterdam of the South,” aiming to be the next big regional export hub for sustainable energy.Regional Infrastructure and CooperationTo make all this work, solid connections are crucial:Rail upgrades: revamping tracks from Paysandú to Montevideo’s port for smooth fuel shipments.Grid interconnections: tying the plant’s renewables into both Uruguay’s and Argentina’s power networks.Pipeline corridors: early talks around CO₂ supply lines and export routes for synthetic fuels across the region.These pieces will lock Paysandú into a larger hydrogen infrastructure map, boosting resilience and widening market access.Market Outlook and Scaling PotentialWith Europe’s Emissions Trading System tightening and carbon markets maturing, demand for carbon-neutral fuels is only climbing. HIF Global’s gigawatt-scale, modular blueprint is built for easy replication—just drop in standardized electrolyzers and synthesis loops wherever they’re needed.Beyond e-gasoline, the same setup can produce methanol or sustainable aviation fuels (SAFs), spreading risk across multiple product lines. As industries face mounting pressure for industrial decarbonization, these diverse revenue streams could spark a wave of export hubs throughout South America.Timeline and Next StepsHere’s the play-by-play:Q4 2025: Switch on the pilot DAC unit to capture 600 t/yr of CO₂.2026: Break ground on the main electrolysis and synthesis plant.2028: Deliver the first e-fuels batches to Porsche and eFuel One.2029–2030: Explore a phase-two expansion to push capacity beyond initial targets.A set of joint committees—made up of government and HIF Global reps—will keep tabs on environmental compliance, draw down financing tranches, and align infrastructure rollouts with industrial decarbonization and ESG goals at every step.About HIF GlobalHIF Global is a front-runner in producing e-fuels from green hydrogen and captured CO₂. With operational sites in Chile and Uruguay and plans for the U.S. and Australia, they’re teaming up with major automotive and energy players to drive the industrial decarbonization revolution.Spread the love

Share this story